Our customers and partners:

Energy Consultancy with Transparency

Consultus International Group has been recognised as the UK’s most trusted energy consultancy and one of the UK’s leading Net Zero delivery partners, and was awarded Consultancy of the Year (Large Customers) at the Energy Live News Awards 2021. We have also been named as the most transparent TPI (third party intermediary) in a Cornwall Insight report on the industry.

We work with businesses and their supply chains to plan, prioritise and achieve their carbon neutral goals, and in the process help them to use less energy, reduce costs, better manage risk, and increase their energy security. Our clients include – Weetabix, Radisson Hotel Group, English National Opera, The National Lottery and Maersk.

An expert energy partner focussed on reducing costs and improving energy efficiency

At Consultus we deliver a bespoke end-to-end solution for our clients to help them meet their carbon reduction goals. Since 1994 we have been specialists in energy procurement and risk management and can provide you with a tailored energy strategy to reduce risk and control costs.

Cost Optimisation & Recovery Audit

Could you be entitled to a refund or credit?

Start your Net Zero journey

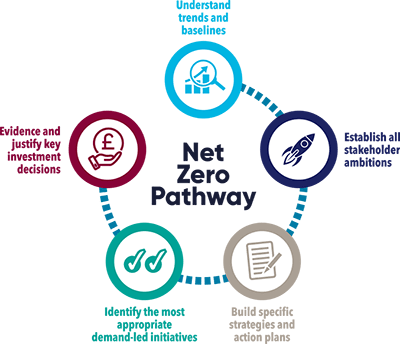

If thinking about Net Zero is giving you a headache, talk to us about following our Net Zero Pathway tool to give you a clear direction and to help you meet your carbon reduction goals.

Our Net Zero Pathway tool was awarded ‘Best Technology Business Solution’ at the Energy Live News Awards 2021. Currently we are working with over 200 clients who have started their journey with us and who now have an action plan to help guide them and to simplify their Net Zero process.

“Consultus provided expert guidance on how we can best achieve our sustainability and net zero performance targets. Consultus made great efforts to understand the nature of our business and offered continued support as we navigated through their fantastic Net Zero Pathway technology.” – Joe Shaw, Sales Manager, SIS Pitches

Take control of your greener future: renewable supply options

The important first steps are to develop your strategy and a plan–a pathway–to achieve your Net Zero ambitions. You can then choose and use what makes most sense. As you would expect, the biggest and most sustained benefits are found in onsite generation, private wire and PPAs.

Discover the top 5 things you should know about PPA’s

Featured Services

Consultus’ revamped Onboarding Academy is officially launched

The Consultus International Group’s Onboarding Academy has officially been launched for new starters. This involved training for the latest group…

Any questions about ESOS?

The Consultus International Group can answer any more questions that you may have about ESOS (Energy Savings Opportunity Scheme). To…

Case Study – The University’s challenge to reach Net Zero

The Consultus International Group have been supporting a leading university, in the East Midlands, to make their Net Zero aspirations…